USDA Lenders : 100% Resource And extremely Lowest Mortgage Rates

USDA Home loans

USDA home loans was money recognized new U.S. Company from Farming within the USDA Rural Development Secured Housing Loan system, which is also labeled as Section 502. USDA fund are around for homebuyers with lower than-average credit ratings or most useful and supply the option for no-money-off. Furthermore, USDA lenders promote quicker financial insurance fees getting individuals and you may below-industry home loan costs.

100% Investment Getting Low-Area Dwellers

To possess home buyers now, there have been two financial applications which offer 100% investment. The first is the fresh on the Company out-of Experts Points. Its offered to most effective army staff and you will experts across the country.

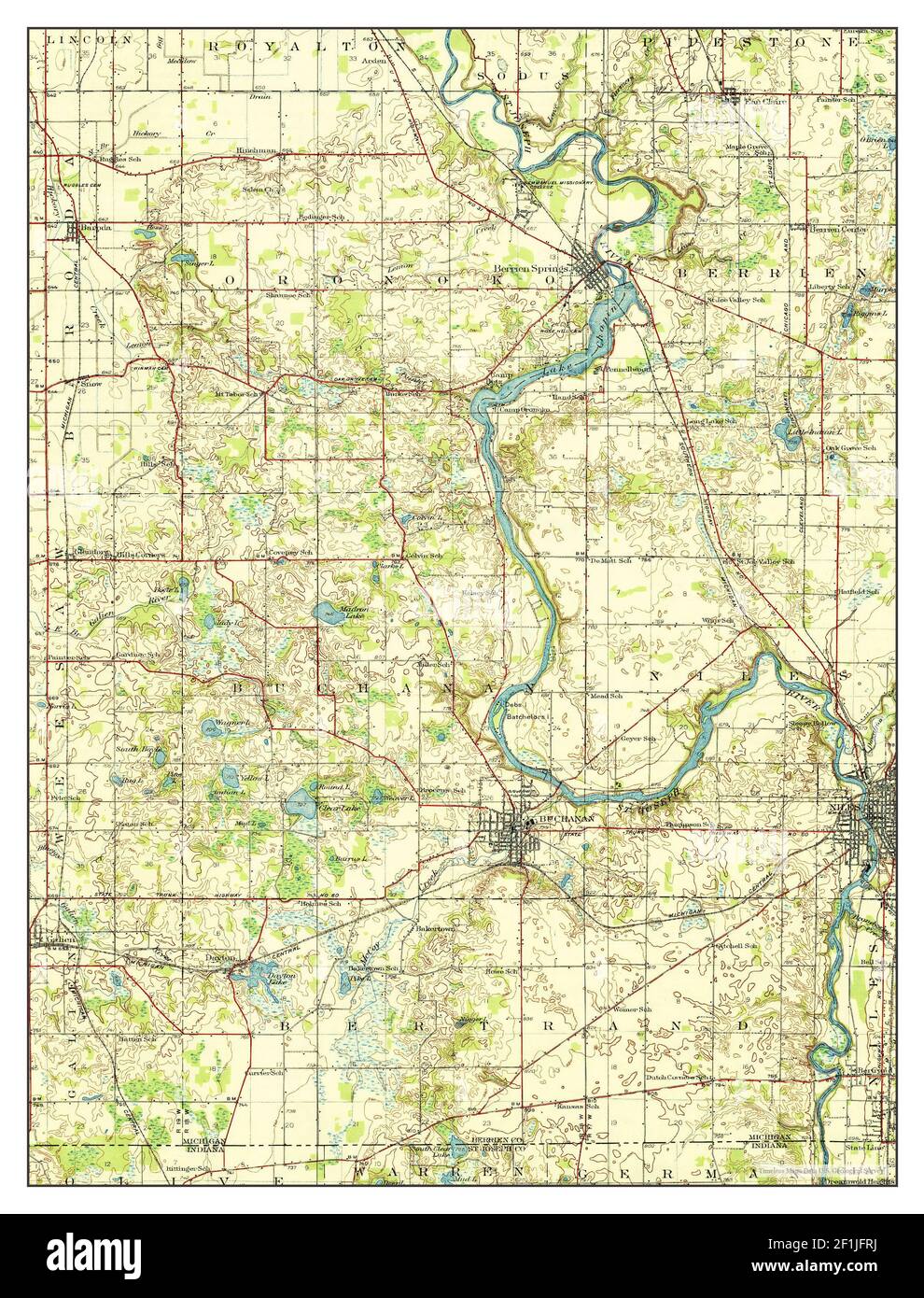

Sometimes called a Outlying Property Loan otherwise a beneficial Point 502 mortgage, the current USDA money isn’t only to possess farms. Because of the way the newest USDA talks of rural, there are many exurban and you may residential district areas all over the country where USDA funds may be used.

Homebuyers whom pick property during the an experienced USDA urban area, and who fulfill USDA income qualification criteria, will enjoy the fresh USDA’s low mortgage cost and an effective system which necessary zero advance payment anyway.

What are the Benefits associated with An effective USDA Financial?

USDA mortgages is planned identical to frequently occurring ones through Fannie mae and you can Freddie Mac. In which they differ, although, is through respect in order to deposit requirements and you will home loan insurance policies.

Unlike antique loans, USDA mortgages do not have downpayment needs, which allows a property buyer to finance a home to have 100 % of the price. The fresh U.S. Department out-of Farming usually evaluate a two % financial insurance rates percentage to all the financing, therefore the rates could be put in the mortgage proportions on the amount of time of closing, as well as the expenses of qualified home solutions and you will advancements.

An alternative RD Loan virtue is the fact their yearly home loan insurance payment merely 0.35% a-year (), no matter what big or small off an advance payment.

That is less than half of the private home loan insurance coverage charged through an equivalent traditional financing, and now have a large coupons on which FHA commonly costs.

The fresh USDA upfront fee and additionally beats compared to FHA. The cost is 1.0% of amount borrowed (), compared to FHA’s step one.75% upfront commission.

Also, because USDA mortgage brokers don’t possess a certain financing proportions limit, home buyers can also be technically acquire more funds which have a great USDA mortgage than just thru traditional, Virtual assistant otherwise FHA pathways.

Money covered by U.S. Service off Farming come since the 30-season fixed rate mortgage loans simply, and have their own USDA Improve Refinance program.

How do i Qualify for An effective USDA Mortgage?

Just like FHA home loans, outlying casing fund are not from the latest USDA. Rather, the USDA assures lenders and work out USDA Area 502 fund facing losses. The application is meant to spur homeownership inside the rural and you can underdeveloped section.

Very first, the customer have to get a house during the a good USDA-qualified urban area. As a whole, USDA property qualifications are ruled by the census tract thickness. But not, the word rural leaves room to have interpretation, opening Area 502 mortgage loans so you’re able to customers inside the unanticipated components of this new nation.

For example, grand swaths out-of California try USDA Rural Mortgage-qualified, as well as every Midwest. Actually New jersey is stuffed with USDA-qualified land.

A customer’s next USDA qualification requirements is the fact household income will get perhaps not meet or exceed 115% of your area’s average earnings. A home loan company will highlight in case your earnings matches system requirements, whenever you are not knowing simple tips to consider.

- The niche possessions must be an initial house

- The customer need to be about 24 months knowledgeable away from a bankruptcy launch

- The customer need top personal loans Indiana to have pretty good borrowing

- The consumer have to satisfy a qualifying proportion out of 29 per cent to have homes can cost you; and you will 41 per cent getting full personal debt

- The consumer might not own a separate household within this driving length out of the topic assets

not, it is important to observe that these tips aren’t steadfast – particularly, with respect to credit reporting and financial obligation-to-income percentages. The financing rating minimum is typically 640, even in the event USDA direction get off step place getting all the way down-credit individuals. Consumers is comparing into the complete electricity of its application for the loan.

It is including why the debt rates should be waived. A purchaser that can inform you a strong credit rating, eg, or strong supplies normally generally become approved in financial trouble percentages into the excess of the recommended constraints.

Based on how Much Must i Get approved Having USDA?

To own today’s home buyers, latest home loan cost are reduced and they’re especially lower into USDA system. The fresh USDA mortgage is designed for lowest cost and you will leniency therefore much time because consumers matches the latest USDA’s assets and you will earnings qualifications requirements.

Get today’s real time mortgage pricing today. The personal coverage number is not required to get going, and all sorts of prices have accessibility your own real time financial credit score.