One last tip when you’re ready to apply for a home loan pertains to your credit score

If you have made a decision to pick a home in the future, it is likely that it will turn into a beneficial choice. Of course, it’s just the initial step from inside the a long processes, one that sometimes wade effortlessly with a great deal of training and you will possibilities available. After you’ve paid on the desire to very own property, if it will probably be your basic otherwise a special you to definitely, you’ll need to know how to pay it off. Preparing for home financing with plenty of browse and you can planning on leading prevent tend to set you up to achieve your goals and you may deals down the line.

Lay a funds

A property is usually the most expensive acquisition of somebody’s life, and you can picking out the financial one to best suits your finances is just one of the most important conclusion might create. That’s indeed enough pressure, therefore going into the techniques being aware what you would like and you may just what can be expected is a superb solution to dump the you to stress.

Very first, need a resources for your brand new home. This may seem sensible to set a resources from the probably home in your area and looking of these to the have you need. However, it might be a great deal more financially in charge first off because of the learning what you can pay for. The basic way to accomplish this is via tabulating your own regular monthly expenses and researching that to your monthly money.

Figuring out your monthly costs might be a daunting task towards the its very own. The fresh U.S. User Economic Safeguards Bureau (CFPB) also offers these suggestions to help make the procedure a little much easier and you will significantly more real:

- Consider your own present lender and you can credit card comments the past at the least two months.

- Start preserving receipts for every get you make and keep maintaining tune of these.

- Register for your own financial government unit in order to automate such or other tasks. myTrustmark by Trustmark even offers Economic Products to help with your financial allowance and you will tune purchasing and money, among other things.

- Try to identify most of the bills to know those you could potentially expect to kept in tomorrow and you can being short term otherwise you will transform later.

- Do not forget to cover coupons on an emergency money, senior years and bad credit installment loans North Carolina other a lot of time-name specifications.

Once you have a good idea of expenses, its easier to figure out how a home loan will fit with the one to formula. Month-to-month costs was scarcely a comparable from just one month to the next, plus they can change entirely quickly. Doing all of your research will allow you to place a good ballpark guess to own home financing you might reasonably afford and place you into track towards the shopping for good household that meets on your own budget.

Know what can be expected

Specifically for first-timers, to buy a property is not something which are going to be hurried into within these early degree. The new CFPB estimates one to half U.S. grownups cannot finances the family expenses at all. However, budgeting is an excellent routine, so don’t get worried from the expenses a few months putting and you can insights your finances. While you’re at the they, you can get added essential tips with the getting back in top shape prior to off applying for a mortgage.

Brand new preapproval process

Prior to stretching that loan to buy your dream house, a home loan company will have to carry out some investigating of its own in the profit. A lot of people always rating preapproved to have a mortgage before they start indeed seeking a property. A mortgage preapproval isnt a vow; it will offer possible homebuyers a strong knowledge of the total amount capable borrow, in addition to household they are able to afford.

- Checking the applicant’s credit score

- Determining assets and monthly money

- Cross-checking you to advice towards the lender’s own mortgage standards

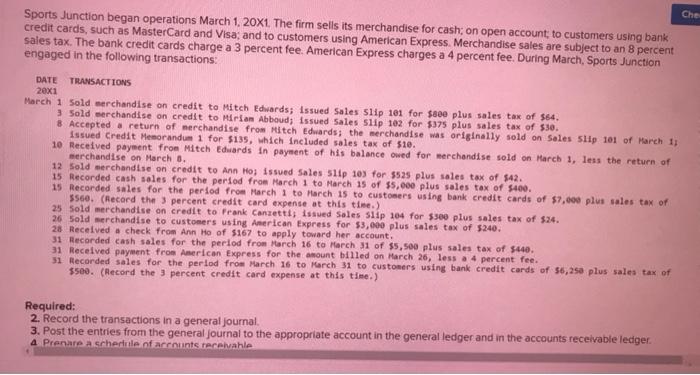

This may want an extended software, plus a few crucial files to prove things are appropriate. When you’re willing to sign up for preapproval, ensure you enjoys these items available to you:

- Personal identification documents just like your delivery certificate, Societal Coverage credit and you can driver’s license.

Since lenders often view everything of your credit history, it seems sensible to take a peek at yours in advance in order to make certain things are specific, and this there aren’t any surprises which may damage your chances to be recognized for a financial loan (such later money or case of bankruptcy suggestions). No matter if your borrowing from the bank was spotless, imagine carrying out of towards making an application for one new sort of borrowing from the bank up until after you’ve already been approved getting a home loan. Detailed with obtaining the fresh handmade cards or auto loans, all of that may reduce your credit rating a little.

The local Trustmark financial gurus is actually desperate to let be certain that all of the step of the mortgage techniques happens smoothly for you. Connect with a lender right now to begin.