New Government Reserve’s recent price clipped might have been in the correct time to possess homebuyers

Key Takeaways

- The newest day out of , is the greatest times to find a house, based on a recent declaration out of Agent.

- There could be doing 37% more active posts in the industry today than just up front of the season, which could make locating the finest family more relaxing for homebuyers.

- Mediocre 31-year fixed home loan pricing are almost step 1 percentage point below into the July, which can help homeowners save far more.

While the Given will not truly perception mortgage cost, it might influence what loan providers costs borrowers. Home loan prices have already softened about levels viewed across the just last year that will be primary time since today begins the latest finest week to invest in a house, centered on Real estate professional.

With more households offered and you can a seasonal lag in demand, Real estate professional claims the times regarding , gives shoppers significantly more house choices to select from. Sufficient reason for average 30-year repaired financial costs nearly 1 payment point below during the July, homeowners could also see higher savings now than during the top june homebuying seasons.

Historical research off Real estate professional reveals to shop for inside a fortnight regarding Sept

According to Realtor, the week of Sept. 31 is among the top minutes to shop for a home because there are far more land in the business and lower request of these residential property. There might be up to 37% more energetic postings in the business now than simply beforehand of the season.

Kirtana Reddy, a keen Austin-depending agent and you will author of the new weekly newsletter Attempting to sell Austin said the blend of these points-large catalog and lower demand-creates a buyer’s field. Consumers could get a better deal to your a property because they wouldn’t pay level rates and will have more freedom to help you discuss.

Need for land could be down this week because of the college schedule. Group have a tendency to search for house throughout the spring season and you will june to maneuver before school seasons actually starts to end pull the students away from group middle-season. This develops battle anywhere between buyers, providing them with a lot fewer options. With a brand new college or university 12 months completely swing, Sept. 29 indicators the start of a seasonal slowdown.

Even though home values are nevertheless high versus pre-pandemic membership, searching this week helps you to save buyers as much as $fourteen,000 typically, predicated on Agent. Which is as compared to june height median domestic cost of $445,000. Straight down request and lower financial costs might assist homebuyers conserve. For the Thursday, Sept. 26, an average price on the a thirty-season fixed mortgage try 6.18%, off ninety base circumstances throughout the July top from 7.08%.

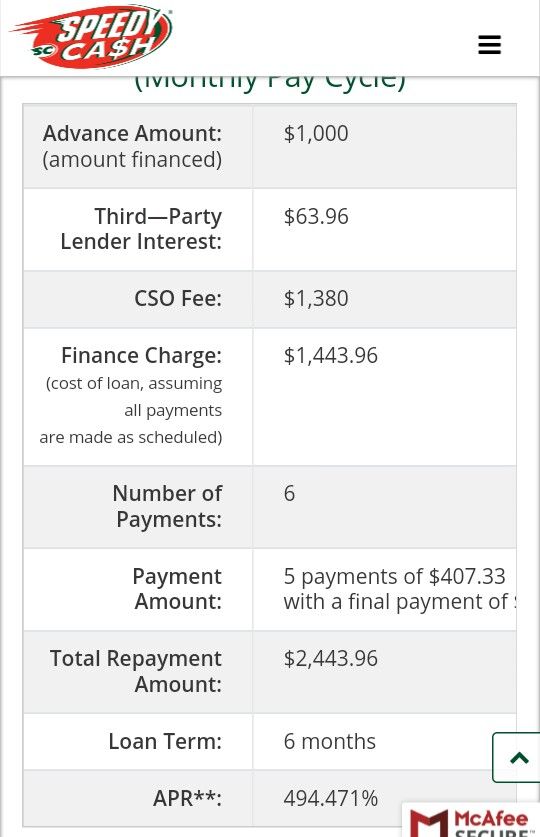

The latest payment towards an effective $445,000 house with a beneficial eight.08% 30-year fixed financial rates could well be $2,388 (not including property taxes or homeowners insurance, and you will incase a 20% down payment). Compared, the payment per month into a great $431,000 domestic ($14,000 lower in rate) having an effective 6.18% home loan price could be $2,107. payday loan Milliken That is a distinction of $281 a month, and $101,160 throughout 3 decades.

Just like the few days out-of Sept. 29 is apparently an educated week to shop for property, it’s just not the sole week to order a home. 31 is also a good idea having consumers. So there is some days in whenever consult decreases and customers are able to find a tremendous amount.

Mike Baker, a home loan company and also the Chief executive officer of your Speed Store inside the Ohio Area, recommends January and March once the most other good times to order a beneficial home. He states this might be before the newest spring season to purchase hurry, that’ll provide consumers a way to score property ahead of consult selections backup.

The state of the fresh new discount might have specific homebuyers with the fence in the if or not now is the best time to invest in an effective family. In last fulfilling, the latest Given announced mortgage loan reduce regarding 50 base issues. That will be likely not the past big date the new Given reduces prices this season or second. Very in the event that you buy today, or watch for all the way down financial cost?

Rates falls might not be extreme enough to avoid inflation, said Kevin Weedmark, a bona-fide home representative into the Austin, Tx. At the same time, insurance costs take an upswing and you can home values continue to raise.

The new housing market, home prices, and mortgage rates can also differ because of the county. Such as for example, an average house price from inside the Nyc condition are $481,773 into the elizabeth big date, the typical 29-season repaired mortgage rate during the Ny are six.14%. When you look at the Western Virginia, the typical family rates within the August is $167,282, because the average 30-year repaired mortgage price are six.52%.

So, whilst it is the best month to shop for a property along the You.S., that maybe not connect with your specific area.

If you are searching to find a property, local plumber would-be once the greatest day is actually for your. Think about your offers, down payment, income, plus before generally making an intend to pick a house. Keep in mind interest rates. And focus on a real estate agent or agent on the town to higher discover your neighborhood housing industry.