Investment Oriented Finance Using A home since the Security

ABLs Playing with A home

Having fun with both individual a residential property and commercial a property while the base to find a corporate loan are an appealing option to help you small business owners who possess security in their home otherwise commercial house otherwise building, and tend to be seeking fool around with you to collateral locate financial support to possess its organization. For the number of commercial property continuously growing, an entrepreneur might look so you can power one a residential property having a 2nd or 3rd lien discover a line-of-credit. The commercial Buildings Opportunity Software Studies latest report about industrial pastime shows you will find no less than 5,600,000 industrial structures in the usa from inside the 2012 – which is a rise of around fourteen% for the past decade. With the rise in what amount of commercial houses (of a lot belonging to small enterprises using the area because the manager-representative services) operator are able to use the net property value this building otherwise property to track down financial support you to definitely wouldn’t be provided with traditional lenders.

What is Advantage Built Credit?

Resource established financing (ABL) is the habit delivering a business funding reliant monetizing the fresh business’s balance sheet. If a company has actually assets for example levels receivables, a home, list, gadgets and you will machinery, they’re able to make use of them since collateral to find funding. The best business utilized for asset built financing are a beneficial line-of-credit, even though asset built identity money are typical. Except that lines of credit and you can label money, other styles out of advantage-centered credit boasts vendor payday loans, factoring, gizmos leasing and invoice funding. If the investment mainly based bank will bring financing with the business, they will up coming place a great lien (UCC-1) with the resource.

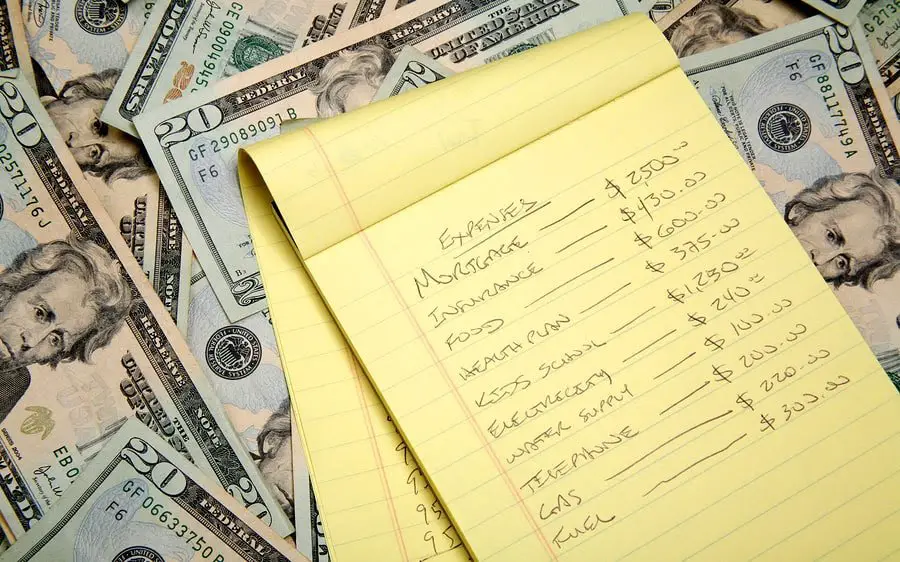

What exactly is Security?

Guarantee is actually a valuable asset one any financial may use to secure a company mortgage. If the financial brings financial support to your home business, they up coming set a UCC-1 lien on providers otherwise individual resource, incase this new borrower fails to pay-off the borrowed funds, the lending company are able to move ahead with seizing this new security to assist recover the loss. By reducing the risk connection with the financial institution, it will echo about rates wanted to new debtor. Safeguarded organization financing playing with guarantee tends to enjoys lower prices than simply unsecured team financing.

What sort of Home Can be utilized As the Equity?

All other industrial possessions are often used to safe asset depending created resource. If you find yourself antique financial will get lay good lien on commercial a residential property when a friends is applicable having a term loan, it scarcely consider explore personal real estate so you can secure investment (while they can make a business manager signal a personal ensure. When they do indication the private ensure, he could be probably pledging each of their personal resource, plus her individual a residential property). Resource built lenders, additionally, will to help you safer funds using a business owner’s individual family, assets and you may/otherwise property. Lenders which can be happy to build advantage mainly based funds using actual house understand that new debtor probably already has a home loan on the residential property, so they really are willing to grab next ranks subordinate to your mortgage lender, nevertheless provide financing for 65 financing-to-really worth.

What kind of Financing is out there When using A property just like the Guarantee?

There are certain resource possibilities getting businesses you to are able to discover the newest guarantee within home. On most useful banks on down seriously to subprime advantage established lenders, there are financial support possibilities structured as the https://simplycashadvance.net/loans/emergency-loans-for-bad-credit/ an expression loan, a personal line of credit, otherwise ACH financing. Very antique financial company loan providers will appear to use industrial genuine property purely as the security getting a term loan. Option investment dependent lenders will appear to use this new guarantee with each other toward business’s cash-flow to incorporate contours-of-borrowing. Subprime house based lenders will usually build the financing comparable to a provider cash advance, where they may need every single day or per week money directly from the company’s bank accounts through ACH. Cost become higher than old-fashioned capital, however, since there is a home used to help you hold the loan, investment established finance having fun with home generally have down rates than higher-attract pay day loan.

Which are the Rates and Terminology

Costs and you can regards to investment dependent loan vary greatly depending upon the type and top-notch collateral getting sworn. Account receivables are apt to have financing-to-worth of as much as 80%, whenever you are catalog and products are apt to have an LTV of around 50%. Asset created financing having fun with a property might have doing 65% LTV even yet in 2nd and 3rd ranks. Cost and additionally differ greatly. Old-fashioned loan providers that provides investment founded fund possess rates in the single digits, while subprime investment dependent financing people have cost that will wade of up to 20%. Terminology vary from around 12 months for the to 5 decades, even when step 1 to three age try most commonly known.

What’s the Procedure of Protecting a valuable asset Based Financing?

The procedure of getting a secured item centered financing varies depending upon the financial institution. If you are looking for more traditional investment created investment, you will need to provide:

- Application

- 3 years tax statements

- 3 years earnings statements (plus season-to-date)

- three years balance sheet sets (and seasons-to-date)

- A/R and you will An effective/P ageing times

- Plan of obligations

- Appraisals out-of guarantee

If you are looking having subprime house based lending playing with sometimes industrial a property or personal property, home or any other assets, make an effort to render:

- Borrowing software

- Lender statements

Once all data are supplied on lenders, we offer the brand new due diligence and underwriting process to just take any where from 1-four weeks.