Best Stock Trading Apps of May 2025: Locate the Best Stock Apps absolutely free Trading, Options Spending, and Long-Term Traders

Associate links for the items on this web page are from companions that compensate us and terms apply to deals listed (see our advertiser disclosure with our checklist of partners for more information). Nonetheless, our opinions are our own. See exactly how we rate services and products to assist you make clever choices with your cash.

Specialist Evaluated

This write-up was expert reviewed by Jovan Johnson, MBA, CFP®reg;, CPA/PFS, and founder of Piece of Wide Range Preparation LLC.

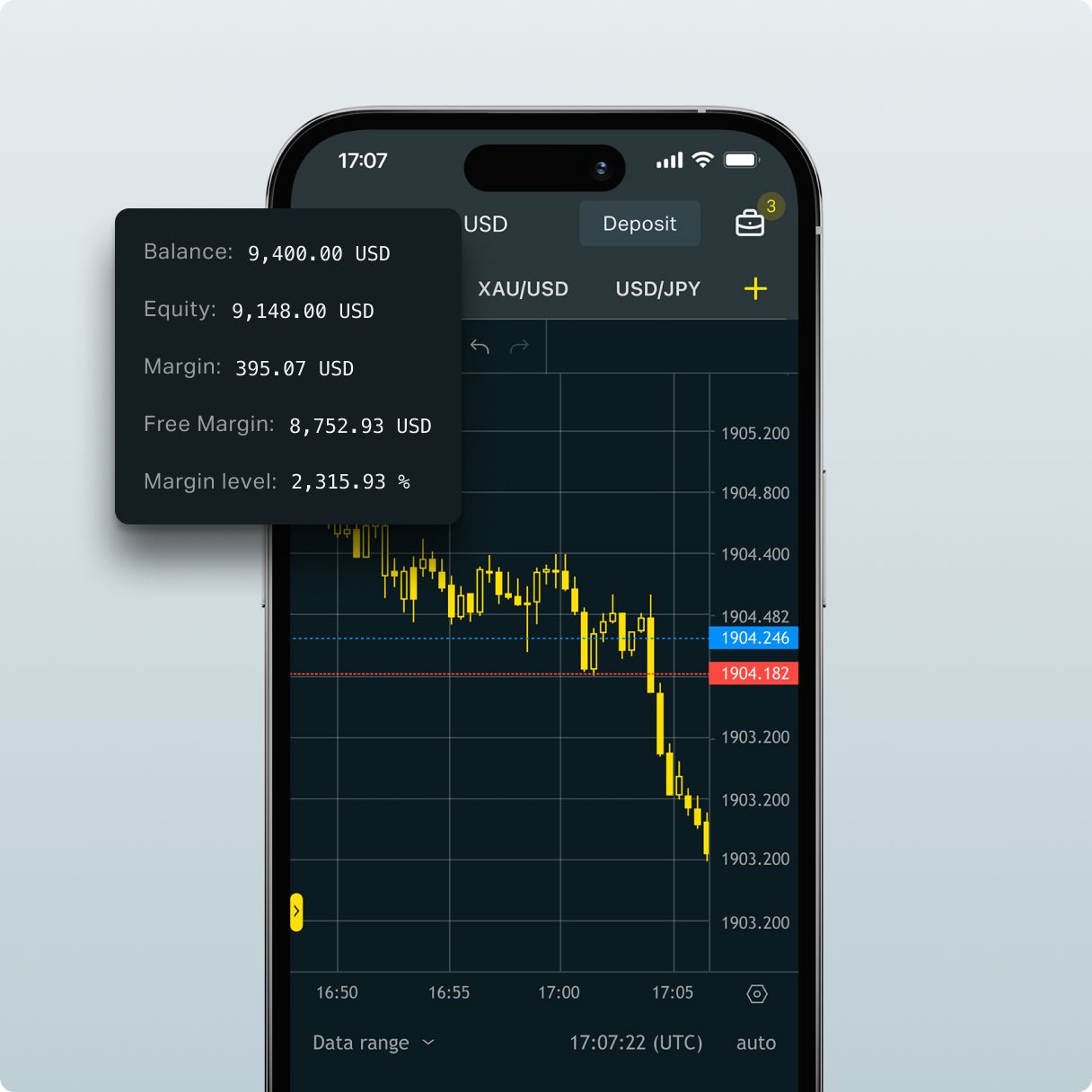

Stock trading apps have reinvented how individuals engage with the market, making spending more readily easily accessible and budget friendly. Todaymobile supply trading platforms offer whatever from beginner-friendly interfaces to advanced charting and advanced trading services tailored towards a lot more seasoned capitalists.

The very best stock trading applications allow you manage and customize your portfolio, gain access to real-time market data, and uncover financial investment possibilities from the comfort of your smartphone or tablet computer.

We assessed and compared loads of stock trading systems to find sector leaders based upon trading attributes, low costs, investment choices, sources, and navigability. All the best applications to buy stocks likewise have high levels of trustworthiness and safety and security.

Have a look at the best stock trading apps with low fees, as selected by Service Expertindividual financing editors in 2025.

Best Stock Trading Applications of 2025

| Best for | Supply Trading App | Minimums |

| Ideal general | Charles Schwab | $0 ($5,000 for Schwab Intelligent Portfolios; $25,000 Schwab Intelligent Profiles Premium) |

| Ideal completely free trades | E * TRADE | $0 ($500 Core Profiles) |

| Best for novices | SoFi Energetic Invest® | reg;$ 0( $1 to start spending ); $5 fractional shares;$2,000 for margin trading |

| Best for long-lasting traders | Fidelity Investments | $0 ($25,000 Integrity Personalized Planning & Recommendations |

| )Best for newbie active investors | Robinhood Investing | $0 ($1 for fractional shares; $2,000 for margin trading) |

| Best for banking and stock trading | Ally Invest | $0 ($100 for Robo Profiles; $100,000 for Ally Invest Personal Suggestions) |

| Ideal for options traders | Webull | $0 ($100 for robo-advisor) |

Why You Ought To Trust fund Us: Our Investing Experts & Technique Best Supply Trading

App Overall For no minimum or costs,

Charles Schwab s supply trading application supplies account adaptability and goal-building features suitable for all type of financiers. Schwab stock trading is our pick for the very best general stock trading app for its ease of use, trustworthiness, low fees, and collection of extensive trading sources and progressed tools. The mobile supply trading application makes seeing your accounts, placements, and equilibriums easy. Track the market with real-time news, stock reports, and profession types. The broker agent has a voice-activated help function called Schwab Aide for voice-controlled trades, quotes, rate of interests, and more. Schwab is also a standout stock platform, particularly for its access to the popular,

industry-leading thinkorswim platform, which is geared toward financiers of all degrees(no added price). Thinkorswim is a customizable trading platform featuring several of the most robust, comprehensive charting, custom sharing, scripts, analytics, and various other innovative trading methods. While experienced financiers get the most out of thinkorswim, much less experienced and intermediate traders can also utilize the system to create and examine different stock trading approaches with a simulated PaperMoney trading account, gain access to support from the Schwab s Profession Desk, or expand their expertise with Schwab s instructional sources, such as video clips, on the internet courses, and short articles. Charles Schwab has a score of 4.8/ 5 on the Apple Store and 2.5/ 5 on Google Play. Pros of Schwab 8,000+ no-transaction-fee mutual funds

and low-cost index funds Sophisticated trading tools and skilled resources 24/7 customer service Disadvantages of Schwab High account minimum Can t trade specific cryptocurrencies Charles Schwab evaluation Best completely free Supply Trading E * TRADE is the most effective trading application absolutely free stock trading for

its affordable prices

More Here bestappstrading.com At our site

and stock-specific trading

devices. Professions of stocks, ETFs

, alternatives, Treasuries, and mutual funds are commission-free

E * profession enhances the trading concepts procedure for supply traders

It aesthetically provides data along with clear descriptions so investors put on t demand to recognize how to translate extensive evaluation and information before making their next relocation. The conventional E * TRADE supply trading app

supplies basic supply trading appropriate for beginners and informal financiers. Although this system prioritizes simplicity, traders can'still access arranged market information, customizable stock watchlists, thorough research study on specific

stocks, and an easy-to-follow grid-like design. However, E * TRADE does not supply fractional shares. If you desire access to a lot more innovative tools, the Power E * profession stock acquiring system uses innovative trading tools. For instance, the stock screener tool filters prospective stock purchasing or marketing possibilities utilizing personalized or pre-defined filters, such as P/E proportions, volatility, or income expectations. E * profession likewise supplies comparable screener tools for ETFs and fixed-income financial investments. While it isn t our top pick for options trading, E * TRADE is still a great trading application for choices. With E * TRADE s Snapsnot Analysis, you can weigh the risk and reward of an alternatives trade with Photo, check for uncommon activity with Existing Scans, or visualize portfolio risk with Threat Slide. E * TRADE likewise provides support from Options Specialists. This is one area E * profession isn t free: Choices bill a $0.65 per contract cost ($0.50 per contract cost if you carry out 30+trades per quarter ). Added perks of E * profession include numerous research service providers( including 100+technological research studies ), adjustable choices chains, and streamlined profession tickets. E * profession has a ranking of 4.7/ 5 on the Apple Shop and a 4.7/ 5 on Google Play. Pros of E * TRADE No minimum to open an account Robust choices trading market screeners and technological indications Commission-free stocks, ETFs, alternatives, Treasuries, and mutual funds Competitive$0.50 per choices agreement when performing 30+professions per quarter Disadvantages of E * TRADE$500 investment minimum for computerized recommendations

Additional charges for infrequent options contracts No fractional shares E * TRADE review Open up an

account with E

* PROFESSION. Best for Beginners While the SoFi

Active Invest reg; application is less durable than some bigger competitors, that very

feature makes it very easy to browse and comprehend if you wear t have as much market experience. SoFi s supply trading application satisfies a broad audience of

capitalists by supplying

taxed and retired life brokerage accounts. While

SoFi s financial investment alternatives are somewhat restricted, a large pool of stocks and

ETFs exists. The

supply application additionally includes educational posts accessible from supply account web pages. If you are brand new to the marketplaces, SoFi supplies a way to get going with a small financial investment and no costs. That s a great combination for discovering exactly how to trade stocks. SoFi bills a 0.25 %yearly advisory

cost based on account balance. SoFi has a ranking of 4.8/ 5 on the Apple Shop and 3.9/ 5 on Google Play. Pros of SoFi'Invest Financial intending aid Commission-free trading $1 to begin investing Cons of

SoFi Invest Presently just available to United States homeowners SoFi Energetic Invest review Open an account with SoFi Energetic Invest reg;. Best for Alternatives Trading Webull is a price cut stock trading system using complimentary alternatives trading, professional market information, crypto trading, and much more via its easy to use mobile application. It also has a thorough internet and desktop computer stock trading system including thorough stock exchange quotes and better analysis.

Catering specifically to options and

futures investors, the Webull stock trading app flaunts several advanced devices and sources, including paper trading,

attracting devices, 63 on-chart

technical signals, 50+technical indications, and

extended trading hours. Beyond progressed trading features, Webull likewise advertises capitalist®education with Webull Learn, which supplies

a comprehensive collection of over 500 courses and training materials. Webull s stock trading application is best for intermediate and skilled capitalists interested in hand-picking commission-free US-listed stocks, ETFs, and choices. Various other innovative trades include inexpensive futures, index alternatives, ADRs, crypto, fractional shares, and

money-market alternatives. Webull has constructed a strong credibility for prioritizing its mobile experience for clients. The app is easy to use, low-priced, and supplies a respectable rates of interest on uninvested cash money. Webull has a ranking of 4.7/ 5 on the Apple Shop and 4.5/ 5 on Google Play. Pros of Webull Commission-free trades people stocks, ETFs, and options Paper trading, market indications and screeners, and customizable tick charts High order execution

top quality Cons of Webull No mutual funds Cryptocurrency trades need a different application called Webull Pay Webull testimonial Introduction to Free Stock Trading Commission-free supply trading apps have made investing more accessible to newbies and cost-conscious capitalists. These systems allow users to buy, market, and trade business

shares without unnecessary purchase fees. While stock professions are one of the most typical investment provided commission-free, many applications provide access to various other securities like ETFs and mutual funds

The Increase of Commission-Free Trading The introduction of commission-free trading changed the game of investing, making purchasing and offering specific inescapable safety and securities much easier and much less

expensive. Charles Schwab, among the biggest and most well-trusted financial firms

, started eliminating trading charges

in the 1970s, paving the

means for various other broker agents

to do the very same. Yet it wasn t till Robinhood launched

its commission-free

supply and ETF trades that no-fee investing came to be stabilized for on-line brokerage firm platforms. Because brokerage companies currently make most of their revenue from passion on money balances, advising solutions, and finance programs, the demand for trading costs has actually minimized. In addition, technological innovations such as automatic trading have actually made compensation charges less appropriate.

Best Stock Trading Apps of May 2025: Locate the Best Stock Apps absolutely free Trading, Options Spending, and Long-Term Traders |