Which contract coordinates new exchange of data towards military consumer grievances also it coordinates measures taken to protect servicemembers

Given that a lifetime army relative, I’ve seen earliest-hands brand new devastating feeling monetary cons and you will predatory credit may have for the the army household. In addition invested six age as the head of the Better Providers Bureau’s Better business bureau Army Line system, and this was a training in my situation about the consumer products and you will scams that affect the armed forces. Unfortunately you can still find too many younger troops studying economic instructions using difficult experience and many years of repaying pricey financial obligation.

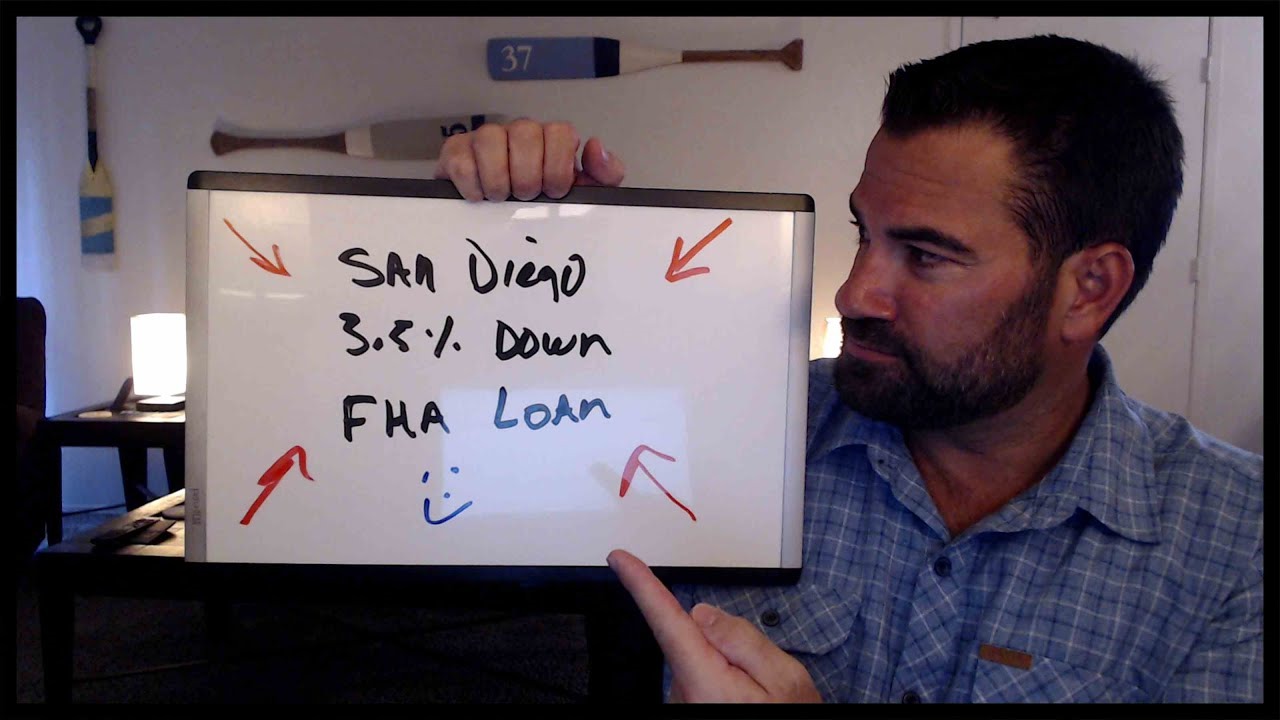

It may be this new kiosk from the shopping center attempting to sell large-charged electronics during the higher still funding, the new lease-to-individual seats store, or perhaps the most recent repayment loans one to manage to exist merely exterior new Armed forces Lending Work concept of pay day loan

From the Individual Financial Cover Bureau’s Office of Servicemember Items, the tasks are: to educate and you may encourage servicemembers and also make better-told choices off individual lending products and features; to keep track of their complaints regarding consumer borrowing products and you can functions – and you can responses to the people grievances; also to accentuate the newest operate out of Federal and state agencies in order to raise consumer cover methods to have military household.

In support of all of our purpose, i signed a combined Declaration of Beliefs towards the Courtroom Endorse Generals (JAGs) of every service twigs. We’ve including arranged a functional arrangement to the Agencies of Pros Situations (VA). We are now it comes people armed forces personnel or pros exactly who label the brand new CFPB’s hot range saying that they are at risk for property foreclosure straight to new Virtual assistant Mortgage Program .

On our informative purpose, I believe it is crucial that you escape and you may tune in to from armed forces families in regards to the issues that concern all of them the quintessential. We have decided personal loans online West Virginia to go to bases all around the Us since i been my personal job past January. I have including met with the National Protect inside the Oklahoma, Ohio, Illinois, and you can Indiana.

What exactly would be the issues that came right up? Earliest, the brand new construction meltdown provides struck army parents difficult once they located purchases to go. Commonly they can’t offer their home getting sufficient to pay back the borrowed funds; they can’t book it to possess adequate to shelter the mortgage payments; they’re told they can not score that loan amendment or brief sale since they are not even delinquent; and so they are unable to refinance getting a great rate since it tend to no more meet the requirements their prominent quarters once they hop out. We’ve got heard about enough cases where the fresh servicemember keeps joined to visit alone on the the brand new obligation channel, which will be very tough when you consider that they ily are now facing a separate separation – this time having monetary explanations.

Our company is starting to select certain confident path on this procedure. Brand new Treasury Service enjoys provided new armed forces-associated recommendations for the Household Sensible Foreclosure Choices program, and you may Fannie mae and Freddie Mac is adjusting her recommendations, also.

Another type of concern is auto loans! Servicemembers are often marketed clunkers from the exorbitant pricing with high financing charge, assuming the initial clunker stops working, could be urged so you’re able to roll the current obligations on the a new mortgage having yet another clunker. There is also yo-yo capital, where servicemembers drive away thinking he’s entitled to funding, just to learn after that the resource decrease using and you can they’ve got to spend more. While the CFPB is only going to enjoys supervisory expert along the auto people just who write their fund, the brand new Federal Change Fee additionally the Government Set-aside must coordinate using my office to your armed forces auto issues, and they’ve got arrived at accomplish that.

Finally, an ongoing point to your armed forces was debt. Of many servicemembers try not to build much money, however it is a guaranteed income and it’s really at the mercy of garnishment exterior of your own regular judge processes. Who may have lead to lots of enterprises seeking provide servicemembers currency.

When servicemembers fall behind within their money, the financial obligation was turned over so you’re able to loan companies. We have been worried about possible violations of Reasonable Business collection agencies Means Act . We now have read reports off loan companies calling servicemembers’ devices 20 times 1 day, threatening them with the Uniform Password out of Armed forces Fairness, and you will telling all of them they will certainly make them busted from inside the review or provides the protection clearance terminated whenever they you should never spend. Nevertheless they will get label the mother and father and you may spouses regarding deployed servicemembers in an effort to encourage them to spend the money for debt within the the newest servicemember’s lack. I also heard about a debt collector telling an excellent widow you to she was required to utilize the funds from her husband’s treat dying gratuity to invest the debt instantly.

There are cases of extremely aggressive revenue of the getting-cash colleges so you’re able to military group as well as their household – out-of one another academic applications and you may pricey private student loans

A majority from my tasks are to educate servicemembers on the liberties around established user monetary regulations, and let them have all the info they have to generate smart financial conclusion. I’m able to keep working to aid select energetic individual safeguards strategies that run part away from armed forces servicemembers.