Rating All of our Specialist help on Mobile A home loan when you look at the Colorado having Less than perfect credit or no Borrowing from the bank

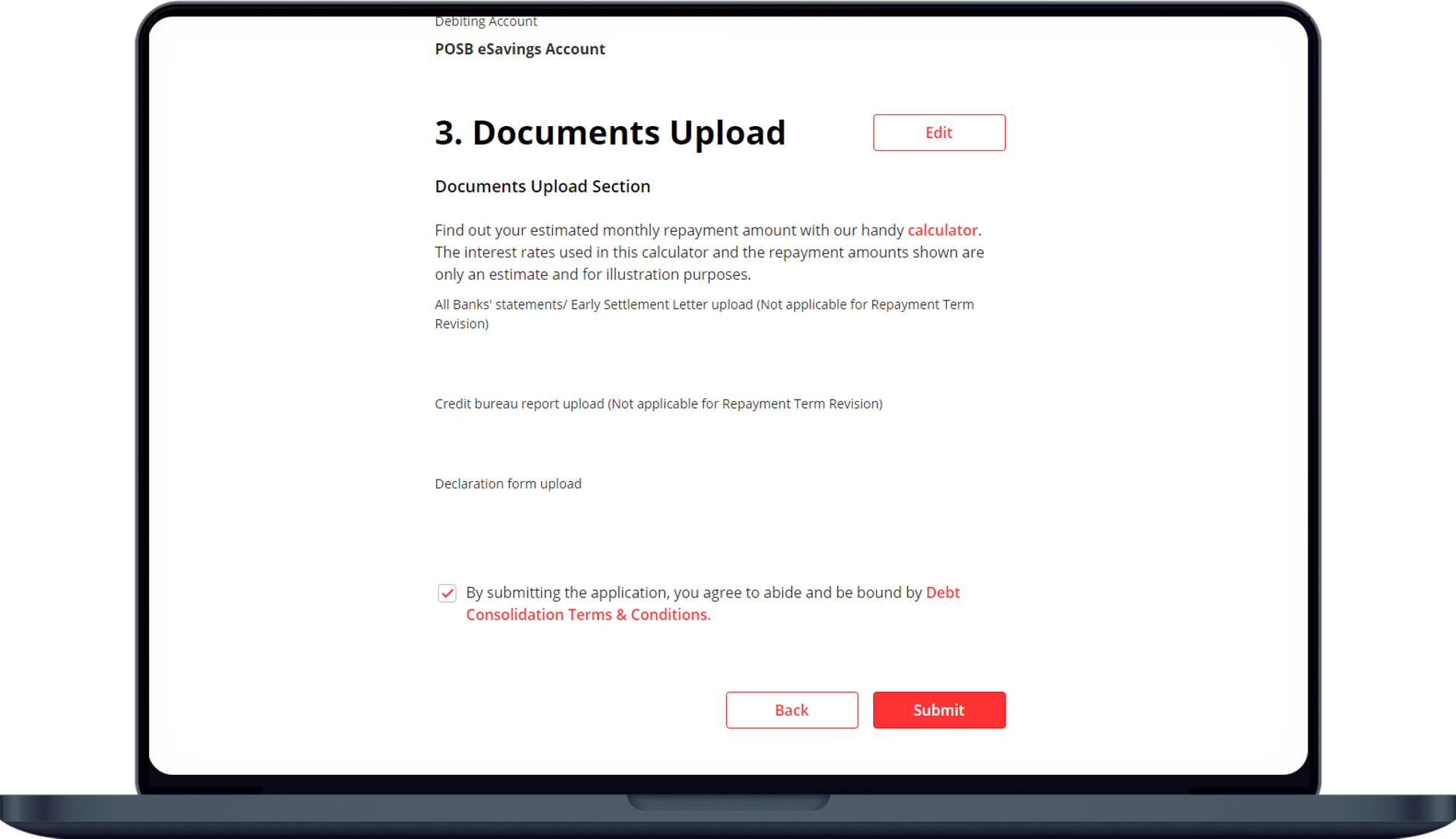

Navigating the method to possess cellular a mortgage inside the Tx which have crappy borrowing from the bank are going to be difficult to do without having the the new answers to the questions you have: Is the minimum credit history good enough getting a mobile family financing? Are there loan custom loans Homewood AL providers which can be willing to work with bad borrowing with no borrowing from the bank people? How can you submit an application for money? In which is it possible you setup a credit card applicatoin because of it? How can borrowing monitors works? What is a good chattel mortgage and how would it be unique of an FHA financial? Just what effect do newest high interest levels keeps to your cellular household financing in Tx?

World-class Home provides the responses you are interested in. We features aided hundreds of Colorado family find the right path to a home loan through its lender of choice. Once we aren’t a finance organization, we can obviously let all of our consumers from the funding process. We’ve got new answers you desire on exactly how to look for are manufactured a home loan with bad credit inside Texas once you acquire one of one’s the latest house!

Features poor credit background having a less than perfect credit get? We can assist! Truly, anyone with one rating is generally score capital getting a cellular family about chief loan providers on the market. Nonetheless it cannot usually make sense to do this because the interest and you may expected deposit tends to be way too high to own your, especially if obtaining a beneficial chattel loan within the Texas. When you have the absolute minimum credit history over 500 and you can a good small down-payment, always we could assist see your appropriate cellular home financing that have less than perfect credit from inside the Texas during the a reasonable interest. But the only way to know certainly is to utilize for a financial loan! For folks who e mail us today we could start the application process which help you manage a brand new credit assessment as well.

Zero Credit score?Need Reconstruct Credit rating?Why don’t we Cam Now!

Should your credit history is actually awesome reduced and you have zero down payment, we can help link your to your useful individuals within 2nd Action. Capable help you make right measures is in a position to order a cellular domestic inside Colorado shortly after restoring their crappy credit or accumulating a first credit score. Next step are an independent low-finances whoever only goal are providing someone get their funds when you look at the acquisition to buy a home. They could help you enhance your trouble of not in a position to secure mobile lenders having poor credit when you look at the Texas. While you are not knowing if you should get in touch with them, or circulate to a cellular mortgage app, call us so we can discuss your role and you may home ownership desires.

Rates Commonly Yourself Apply at Are designed A mortgage Options

Large rates of interest may have a primary influence on mobile home financing repayments, it doesn’t matter how brand of mortgage your safe. If you have bad credit or no borrowing from the bank, you are going to typically have an even higher interest rate on your mobile home loans because of less than perfect credit. This might be exacerbated from the latest highest rates from the financing sector. This should basically become correct both for chattel money, FHA finance and other brand of are designed lenders.

Including, an FHA financing usually requires 3.5% of pricing to get off since the an advance payment, which is very economical, but you’ll have to pay all of those other mortgage in the newest rates of interest if you do not re-finance later. Which have an extended identity mortgage happens additional time for desire in order to collect. The total amount borrowed is probable going to be much bigger at the end of increased interest rate mortgage than simply with a short term mortgage during the a lesser rate.

How to Reduce the Effectation of Large Interest rates On My Property Processes?

To attenuate the outcome of great interest prices in your are formulated domestic financial support preparations, there are many possibilities you could potentially bring. You can look at spending way more beforehand getting a smaller loan period having smaller interest money, and thus faster full amount borrowed towards the financial. You might wait for rates of interest to go down to an excellent peak you to definitely possess their month-to-month financing repayments manageable for the newest financial situation. You could potentially work on Step two or another business to improve your credit rating and lso are-submit an application for a diminished interest rate chattel mortgage or FHA financing. In the long run, you could choose to go after your residence to shop for arrangements anyway with the latest hope of refinancing in the a lower interest rate on the coming If the rates would go-down.